None of the governments in Pakistan, either military or civilian, has ever followed directions of Apex Court in making tax appellate system independent and separate from Executive – FPCCI President

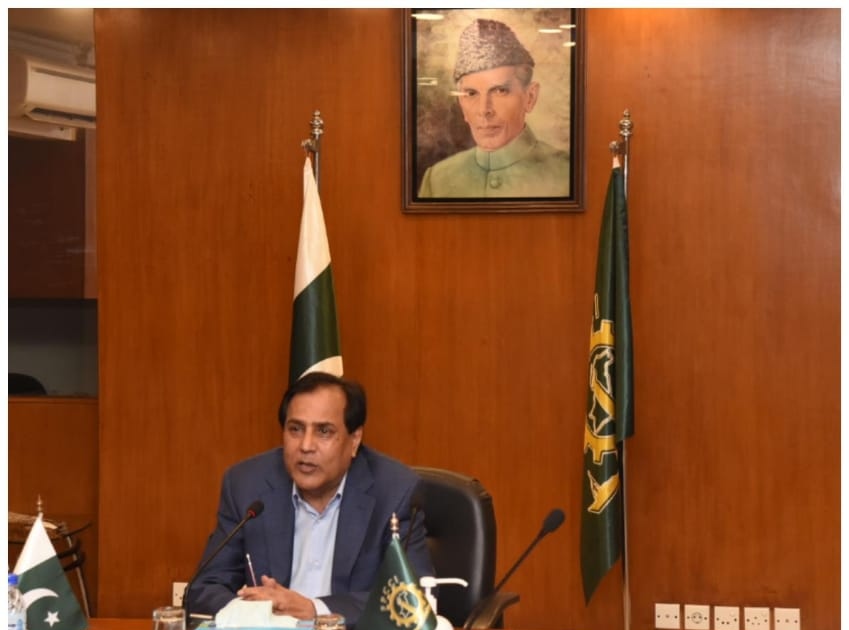

Karachi: Mian Nasser Hyatt Maggo, President, Federation of Pakistan Chambers of Commerce and Industry (FPCCI) has appealed the Chief Justice of Pakistan to take suo motto action for separation of Judiciary from Executive.

In a petition sent to the Chief Justice of Supreme Court, he said ‘this is a matter of violation of fundamental right of citizens’ and therefore reforms in tax appellate system may be introduced on priority basis.

“Dispensation of justice in the first two-tier of tax appellate system is not only unconstitutional but also on the verge of total collapse due to its subservience to the Executive and large number of pending cases for which FBR is also aggrieved that billions are stuck up in litigation at various tax appellate forums. “

Maggo said, “It is a matter of record that none of the governments in Pakistan, either military or civilian, has ever followed directions of this Court in making tax appellate system independent and separate from Executive”. Giving powers to Prime Minister of Pakistan to regulate the affairs of Appellate Tribunal Inland Revenue and Customs Tribunal may be declared ultra vires of the Constitution being in utter violation Article 175 (3) of the Constitution and principles laid down by this august Court in this regard, he requested.

Nasser Hyatt said, “Thousands of cases are pending in Appellate Tribunal Inland Revenue (ATIR) and Customs Tribunal and heavy pendency of tax references in different High Courts of the country that may be ordered to be decided expeditiously by constituting special and exclusive benches for this purpose till the time ATIR and Customs Tribunal are placed under direct supervision of respective High Courts and preferably under this Court as is the case of Federal Service Tribunal. On October 12, 2020, the Chairman of FBR, while testifying before the Public Accounts Committee (PAC), revealed that more than “Rs1.856 trillion-revenue has been stuck for years due to litigation in various courts, resulting in difficult financial conditions for the country”.

In his request Nasser Hyatt said that on behalf of all trade body members of Federation of Pakistan Chamber of Commerce & Industry (FPCCI), this Human Rights Case/ Public Interest Litigation Application is being filed for the protection of fundamental right of access to justice for all citizens of Pakistan that has recently been highlighted by this Court in Para 2 of its judgment in Const. P.17 of 2019 and others as under:

“In fact, an impartial and independent judiciary is universally recognized as a core value of any civilized democracy. This is evidenced by the international conventions that protect this value as a fundamental right of the people (ref: United Nations Basic Principles on the Independence of Judiciary and the (Montreal Universal Declaration on the Independence of Justice). The significance of an independent judiciary is also deeply embedded in Pakistan with the Constitution itself guaranteeing in its Preamble that: “…the independence of the judiciary shall be fully secured.”

Even this Court in its pronouncements on the meaningful working of the Constitutional scheme of trichotomy of powers has many a times reaffirmed that the judiciary must enjoy confidence of the litigants and the general public in its impartiality and commitment to dispense justice in accordance with law. A prerequisite for these attributes is the guarantee of independence of the judiciary, a fact which this Court acknowledged in the case of Muhammad Aslam Awan vs. Federation of Pakistan.

“Our case relates precisely to non-implementation of “the separation of Judiciary from the Executive” that is a Constitutional mandate under Article 175 (3) of the Constitution of Islamic Republic of Pakistan as highlighted in the above quoted judgments of this Court. This right is an essential prerequisite for the enjoyment of; inter alia, the principal fundamental right of access to justice which is guaranteed to the people of Pakistan by Articles 4, 9 and 10A of the Constitution.”

He said, “In any society, administration and dispensation of justice should be the top most priority. A society without a sound, reliable and speedy judicial system, which does not ensure effective dispensation of justice, cannot survive for long as justice (Adel) is an article of faith in our religion, whether that may be against our kith and kin or against the rich or poor. The fourth rightly-guided caliphate Hazrat Ali bin Abi Talib (AS) summarized it most aptly: “System of disbelief (kufr) can work but system of injustice cannot work”.

“Administration and dispensation of justice under the various tax laws in Pakistan call for serious and immediate attention, the entire system being on the brink of disaster. There is an urgent need to ensure “justice”, “rule of law”, “fairness”, “equity” and independence of tax appellate authorities from the control of administration.”

“It is tragic that Appellate Tribunal Inland Revenue (ATIR) and Customs Appellate Tribunal first through Tax Laws (Second Amendment) Ordinance, 2019 and then through Finance Act 2020 were made totally toothless that they cannot even frame their own rules to regulate affairs relating to constitution of benches and their working. This power has been given unconstitutionally to the Prime Minister of Pakistan and till today this unconstitutional act remains unnoticed. The amendments to this effect made in section 130 of the Income Tax Ordinance, 2001 and section 194 of the Customs Act, 2019 were in flagrant violation of Article 175(3) of the Constitution. This is complete captivation and subservience of tax appellate tribunals to the Executive.”

“Everybody is totally dissatisfied with the existing tax appellate system. Those imparting justice complain about lack of facilities and huge number of cases, the complainants crying for early orders but forced to wait for years, and the revenue persistently worrying about blockade of colossal amount of money in the litigation process,” he contended.

“In view of the above, it is humbly prayed that the matter may kindly be taken as Human Rights case inter alia and notices be issued to all the relevant authorities (Federation of Pakistan through Ministry of Law, Federal Board of Revenue (Revenue Division of Ministry of Finance), the Attorney General of Pakistan and or any other organ/ institution related with the matter”, President FPCCI Mian Nasser Hyatt Maggo concluded. (PR)

_____________________